The third quarter of this year presented unique challenges for the radiant heating industry as home sales activity continues to be influenced by various factors. However, this period has also allowed us to identify several surprising growth drivers for the company, including significant gains in snow melt cable sales.

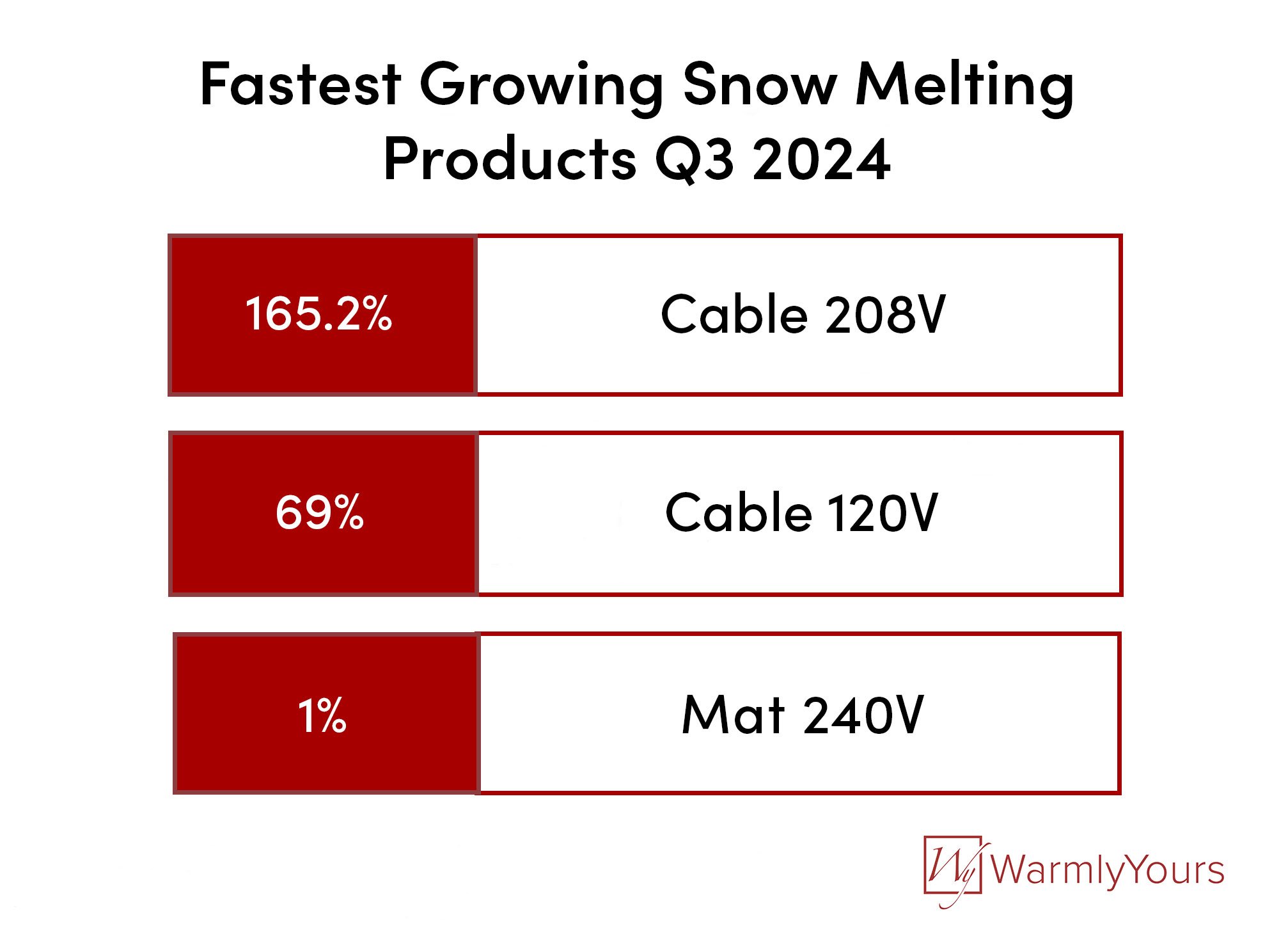

For WarmlyYours, third-quarter sales of snow melt cables increased significantly for both 120V and 208V variants in year-over-year sales, making it one of the fastest-growing product categories in the radiant heating lineup.

This growth in snow melt cable sales may signal a comparable impending upswing across other product lines nationally, as some metrics indicate that home renovation spending could see promising growth in the near term.

In this report, we’ll take a closer look at the performance of radiant heating product sales, with a specific focus on snow melting cable sales, and analyze the impact that the national housing and remodeling markets are expected to have on future sales.

WarmlyYours Product Sales in Q3 2024

In addition to growth in snow melting cables, we also saw significant growth for a number of other radiant heating products.

For floor heating, the fastest growing product was our Slab Heating Mat, which was up 65.8%. This product is embedded inside of concrete slabs during new construction. The growth in this product is likely fueled by a big increase in floor heating projects that involve additions being added to homes (these additions generally require the pouring of a concrete slab) which are up 31.8% in year-over-year sales.

Another popular product has been the TempZone Shower Mat, which is a heating mat with a hole for the drain flange already incorporated into the design. The TempZone Shower Mat was up 15.1% in year-over-year sales. This heating element is embedded beneath tile showers and is a great way to make sure there are no cold spots in your shower where the warm water can’t reach and it can also help dry your shower floor after use to prevent mold or mildew. It’s no surprise that this product’s growth is hand-in-hand with a 3.8% increase in floor heating projects for showers.

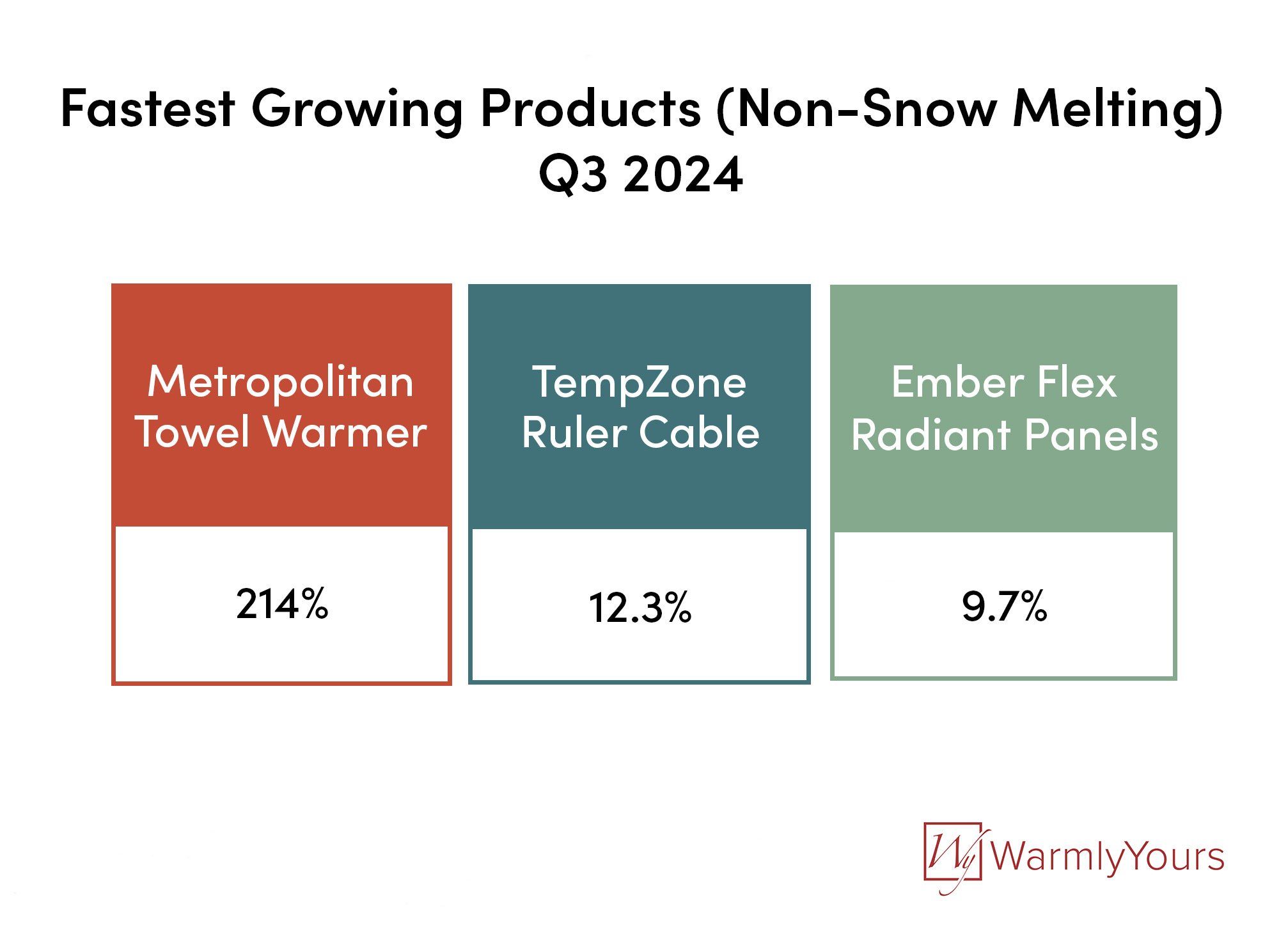

But the most popular floor heating element (in terms of sales volume growth) was the TempZone Floor Heating Ruler Cable, which is a trade pro exclusive product. This heating element features hash marks at every half-inch interval and that allows installers to make sure they’re on track during every step of the project with the free installation SmartPlan that WarmlyYours provides. This product was up 12.3% in year-over-year sales and we expect this product to continue to grow as more and more trade professionals experience how much easier it makes floor heating installs.

For towel warmers, the fastest growing model was the Metropolitan at 214% growth when compared to last year. This model has been popular for some time due to its elegant straight design lines and its highly polished finish, not to mention its technical features like dual-connection electrical hookup and TempSmart overheat protection making the product safe for children and seniors.

Similarly, the most popular radiant panel products have been our Ember Flex Radiant Panels, which are up 9.7% year-over-year. These affordable panels can be installed on your wall, your ceiling, or can be freestanding (with accessories). This level of flexibility has ensured their popularity will continue to grow with both trade and homeowner customer segments.

Snow Melt Cable Sales in Q3 2024

While consumer interest in snow melting systems typically peaks in Q4 and Q1 when snow is on the ground, snow melting sales have historically been strongest in the third quarter as this time of year often aligns with related renovation projects like the installation of patios, driveways, and outdoor stairs. This is because snow melt heating elements are embedded in these outdoor surfaces during installation.

The most significant sales growth gains were for snow melt cables but we also saw the 240V snow melt mat (up 1%) grow in popularity. This product can be used to cover a larger coverage area than comparable 120V products due to a lower power demand per square foot. This makes the 240V snow melt cable a popular option for heated driveways, which made up nearly one-third of all snow melt projects so far in 2024.

In contrast to snow melt mats (which consist of heating cables securely attached to a fiberglass mesh), snow melt cables are often installed by attaching them to a rigid framework that is then also embedded in the outdoor surfaces. This means that cables are more labor intensive to install than mats, but they’re also more flexible in terms of installation and are great options for rounded or circular projects. Snow melt cables are also useful for installing heated outdoor stairs.

The two most popular snow melt cables were the 120V (up 69%) and the 208V (up 165.5%). The core difference between these products obviously stems from their input voltage but they’re also different in the types of projects that generally use them.

120V heating elements are typically used in smaller residential projects for two core reasons: 1.) most homes in the U.S. have 120V as their default home power; 2.) As discussed earlier, 120V heating elements are used in smaller projects because they have a higher per square foot power draw than 240V elements.

Similarly, 208V heating cables are also used for smaller applications but are often found in commercial projects given the input voltage. When compared to 277V heating elements, 208V heating elements have a higher power draw per square foot.

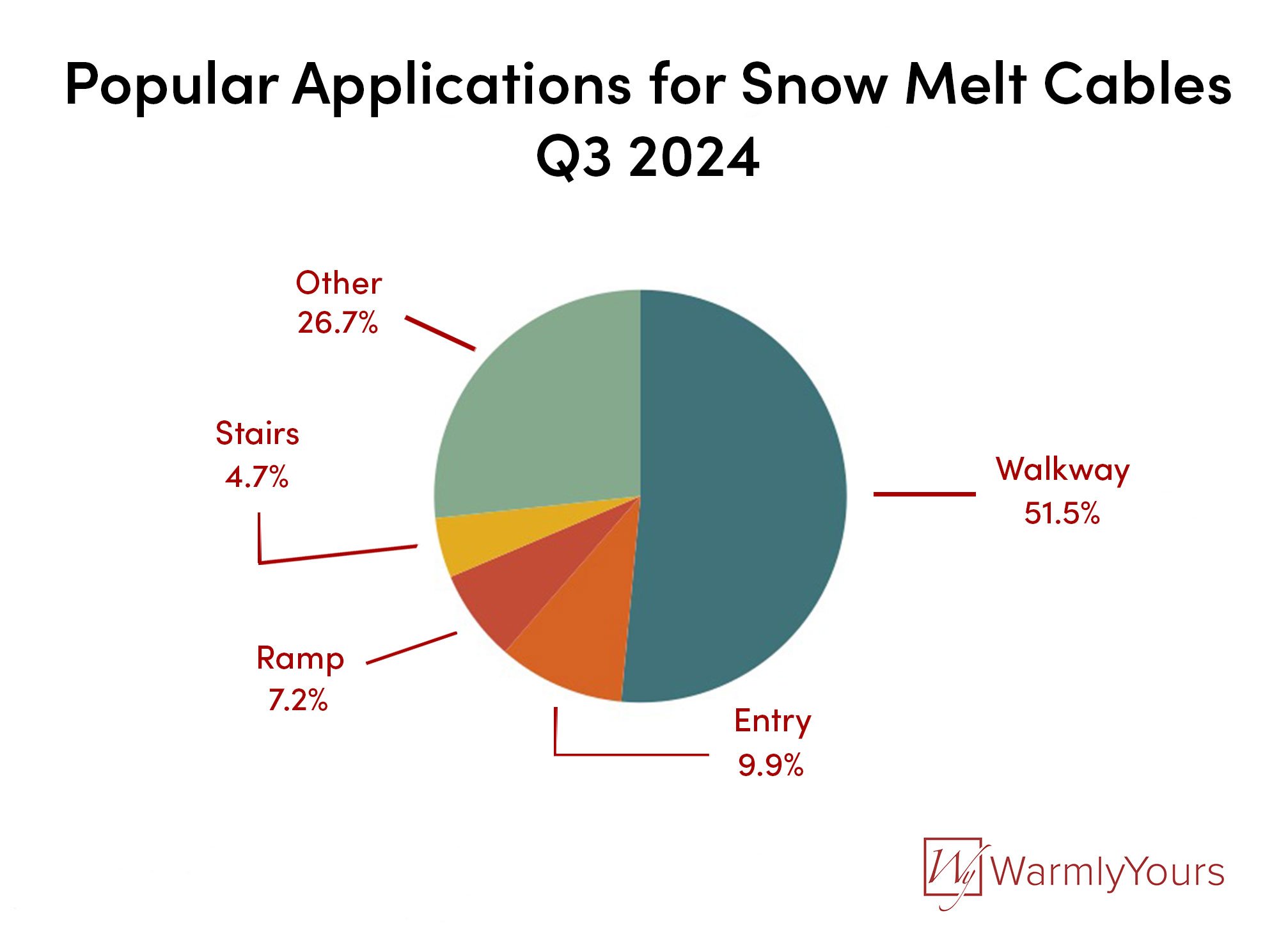

Because the two fastest growing snow melt cable products have these intrinsic characteristics, their growth speaks to changing trends in snow melting installations. One of the most notable areas of change has to do with the types of projects incorporating 120V and 208V snow melt cables. So far in 2024, here are the most popular project types in order of sales volume: walkways, entries, ramps, and stairs.

In 2023, walkways only made up 37% of total snow melt sales for 120V and 208V cables. So far this year, they make up 51.5%. This shift is in line with several years of buildup for walkways as more and more elderly homeowners prepare to “age-in-place”. A snow melting system is of paramount importance to anyone concerned about stability on outdoor surfaces during the winter months as it will not only melt the snow but also be set up to continue running until the melted snow has evaporated.

This concern for safety also explains the uptick in entries as a project type, which were up from 5.2% in 2023 to 9.9% of all snow melt projects in 2024. Ramps and stairs also saw significant growth and are crucial for maintaining safety for homeowners. Julia Billen, owner and president of WarmlyYours, said this emphasis on safety is precisely why the company began carrying snow melting systems in the first place.

“I don’t think there’s a product line in our pretty expansive portfolio that I’m prouder of than snow melting,” said Billen. “We’ve worked really hard as a company to make sure the public knows about snow melting. It’s not just about convenience, it’s about safety.”

Billen cited the fact that around 100 people die in the U.S. every winter while shoveling snow as one of the reasons she feels so strongly about advocating for snow melting systems.

“I love floor heating and towel warmers and I really do believe there is incredible meaning in improving people’s lives through comfort but, with snow melting, I don’t think it’s an exaggeration to say we’re potentially saving lives,” said Billen. “And that’s the kind of thing that makes it easy to go to work every morning.”

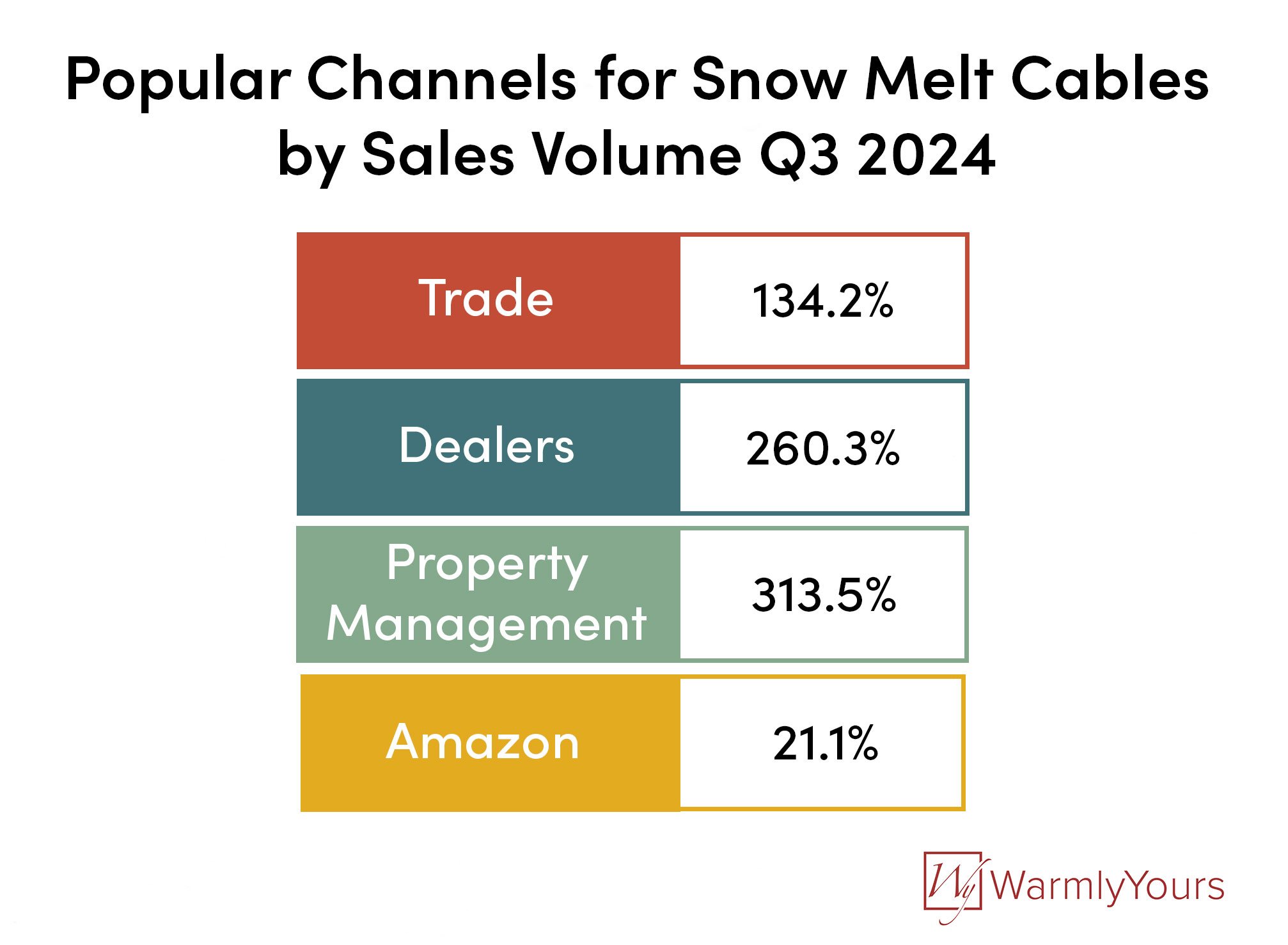

The growth for these product types is also instructive regarding which customer segments were growing during the same time period. Here are the customer segments, ordered by sales volume, that saw the biggest uptick in sales of 120V and 208V snow melt cables: trade (up 134.2%), dealers (up 260.3%), property management (up 313.5%), and Amazon (up 21.1%).

Growth for the trade and dealer channels, as customer segments, is generally tied to a pickup in sales so it’s not surprising to see the increase for these groups. However, it is worth noting that dealer growth was largely driven by the 120V snow melt cable while trade saw more sales of both the 120V and 208V cables.

Amazon as a customer segment is a helpful indicator of general consumer interests, particularly online. The growth for sales of 120V and 208V snow melt cables is a fairly recent trend given that the Q3 growth rate is 21.1% while the year-to-date growth rate is 5%. This is consistent with sales trends for other snow melting products in ecommerce and probably reflects the fact that installation projects that could incorporate snow melting are being undertaken in the fall.

But perhaps the most interesting customer segment that showed growth for sales of these snow melt cables was property management. This group contains a multitude of different customers that range from large sale commercial real estate organizations to the custodians for smaller, luxury oriented rental multi-family properties. However, something that they all have in common is that they have a professional interest in increasing the safety of their properties during inclement weather.

Salt or other chemical agents are often used to keep walkways, entries, and outdoor stairs clean but this can have a bevy of negative impacts on animals, vehicles, and outdoor surfaces. Likewise, portable snow melting mats can be bulky and an eyesore. Electric snow melt systems present a discrete but effective alternative, which has made them attractive to a wide range of different customers.

For the future, we expect to see continued gains for the 120V and 208V cable products but we also expect to see 240V and 277V cables make improvements as many heated driveway projects (which tend to be larger in terms of heating coverage so they are often quoted with 240V or 277V heating elements) have already begun in the early parts of Q4.

The National Housing and Remodeling Markets in Q3 2024

The demand for radiant heating products, including floor heating and snow melting systems, is strongly influenced by the real estate market and home renovation trends. Homeowners often undertake remodeling projects to prepare a property for sale or to customize their new home to match their preferences after buying.

While the renovation and remodeling markets have been depressed by a lack of available inventory, there are some indications that this might be changing. According to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau, starts of single-family homes were up 2.7% over last year. On a year-to-date basis, new starts for single-family homes are up 10.1%.

“Single-family construction increased in September, mirroring NAHB’s survey of builder confidence,” said Carl Harris, chairman of the National Association of Home Builders (NAHB). “In the long-run, the most effective way to tackle the nation’s housing affordability crisis is to increase the housing supply.”

According to the National Association of Realtors (NAR), pending home sales were up 7.4% in September from the previous month and up 2.6% in year-over-year sales.

“Contract signings rose across all regions of the country as buyers took advantage of the combination of lower mortgage rates in late summer and more inventory choices,” said NAR Chief Economist Lawrence Yun. “Further gains are expected if the economy continues to add jobs, inventory levels grow, and mortgage rates hold steady.”

While pending home sales had accelerated in September, existing home sales saw some backsliding. According to NAR, existing home sales dropped 1% from the previous month in sales in September of 2024 and 3.5% from September 2023.

“Home sales have been essentially stuck at around a four-million-unit pace for the past 12 months, but factors usually associated with higher home sales are developing,” said Yun. “There are more inventory choices for consumers, lower mortgage rates than a year ago and continued job additions to the economy.”

But perhaps the biggest indicator of positive growth potential based on home sale activity is how much available inventory has recently come to the market. According to NAR, September 2024 ended with some positive news regarding the total supply of home units.

“Total housing inventory registered at the end of September was 1.39 million units, up 1.5% from August and 23.0% from one year ago (1.13 million). Unsold inventory sits at a 4.3-month supply at the current sales pace, up from 4.2 months in August and 3.4 months in September 2023.”

Perhaps this influx of available inventory is why many remodeling benchmarks are posting positive projections. According to the Leading Indicator of Remodeling Activity (LIRA), a quarterly assessment from the Joint Center for Housing Studies of Harvard University, they expect annual homeowner spending on renovations and repairs to grow by 1.2 percent through the third quarter of 2025.

“A continued thaw in new home construction and sales of existing homes bodes well for an uptick in residential improvement and repairs next year,” said Carlos Martín, Director of the Remodeling Futures Program at the Center. “Additionally, stronger gains in home values and thus home equity levels should boost both discretionary and ‘need-to-do’ replacement projects for owners staying in place.”

The Center further expanded this point in their press release.

“Annual spending for home improvements and maintenance is projected to grow from $472 billion today to $477 billion through the third quarter of 2025,” said Abbe Will, Associate Director of the Remodeling Futures Program. “A quick return to growth after a fairly modest downturn ultimately means that residential remodeling and repair expenditures are expected to approach past peak levels moving forward.”

For WarmlyYours, we fully expect to see significant growth continue in snow melting as there has been a sizable uptick in heated driveway projects being quoted so far this quarter. Additionally, we expect to see huge increases in sales of the TempZone Floor Heating Ruler Cable continues to make in-roads with flooring professionals.

Sources:

- Relevant WarmlyYours internal sales data and website analytics reports

- https://www.jchs.harvard.edu/press-releases/turn-growth-expected-residential-remodeling

- https://www.nar.realtor/newsroom/almost-90-of-metro-areas-posted-home-price-increases-in-third-quarter-of-2024

- https://www.nar.realtor/newsroom/pending-home-sales-advanced-7-4-in-september

- https://www.nar.realtor/newsroom/existing-home-sales-slid-1-0-in-september

- https://www.nahb.org/news-and-economics/press-releases/2024/10/single-family-starts-trend-higher-in-september

- https://www.bbc.com/news/blogs-magazine-monitor-30119410#:~:text=Every%20winter%2C%20about%20100%20people,US%20die%20while%20shovelling%20snow.